Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

Every landlord knows the drill. You find a qualified tenant, they pass screening, you're ready to sign, and then they hit you with it: "We need a first-of-the-month move-in."

It sounds reasonable. Leases traditionally start on the 1st. It's cleaner for accounting. The tenant's current lease probably ends on the last day of the month. Everyone does it this way, right?

Here's the problem: that accommodation is costing Chicago investors real money. And after looking at our 2025 leasing data, I can tell you exactly how much.

The Numbers Don't Lie

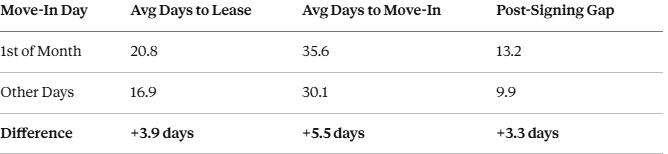

Out of all our 2025 move-ins, 28% landed on the 1st of the month. That's not surprising, it's the default everyone gravitates toward. But here's what happens when you compare those move-ins to properties where tenants moved in on other days:

Properties with 1st-of-month move-ins sit vacant 5.5 days longer on average. And 3.3 of those days come after the lease is already signed, pure waiting time while a rent-ready unit generates zero income.

We wont go into other risks like squatters but here how this Chicago Landlord set his yard on fire to chase out a squatter.

On a $2,000/month rental, that's $365 walking out the door every single turnover. On a $1,500 unit, it's $274. Multiply that across your portfolio and over multiple years, and you're looking at real money.

Why This Happens

The math behind the first-of-the-month penalty is straightforward once you think about it.

When a tenant insists on a 1st-of-month move-in, they're essentially asking you to hold a property for them. If they sign a lease on the 20th for a May 1st move-in, that's 11 days of vacancy baked into the deal before they ever pick up a key. If they sign on the 15th, it's 16 days.

Meanwhile, a tenant who signs on the 20th and moves in on the 23rd? Three days. That's the difference between losing half a month's rent and losing a few days.

There's also a self-selection factor at play. Tenants who require 1st-of-month move-ins tend to be more rigid in their timelines, they're often syncing with an existing lease or coordinating logistics that don't flex easily. Tenants who can move mid-month are often more motivated, more flexible, and ready to act fast.

The 15th Isn't Much Better

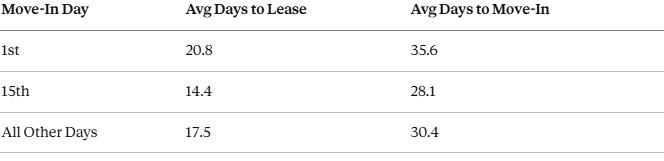

You might think the 15th of the month, the other popular "clean" date, would perform similarly to the 1st. It doesn't:

The 15th actually outperforms both the 1st and the overall average for other days. Why? Tenants targeting mid-month move-ins are often breaking from a traditional lease cycle, which usually means they're motivated, maybe a job relocation, a lease break, or a life change that requires speed over convenience.

The 1st-of-month crowd, by contrast, is often waiting out their current lease to avoid overlap or penalties. That waiting translates directly into your vacancy.

The Chicago Effect

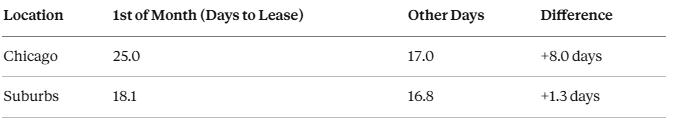

Here's where it gets interesting. The first-of-the-month penalty hits Chicago properties much harder than suburban ones:

In the suburbs, first-of-month move-ins barely move the needle, just 1.3 extra days to lease. But in Chicago, the penalty is 8 full days. That's dramatic.

The likely explanation: Chicago's rental market has more month-to-month flexibility and a higher concentration of tenants tied to traditional lease cycles. Suburban tenants, often families coordinating with school schedules or job relocations, move when they need to move, regardless of the calendar.

Also, Chicago tenants, especially on the North and Northwest side tend to start looking sooner for their next place. Instead of looking and finding 14-21 days out they are looking 45-60 days out.

When Week You Move In Matters

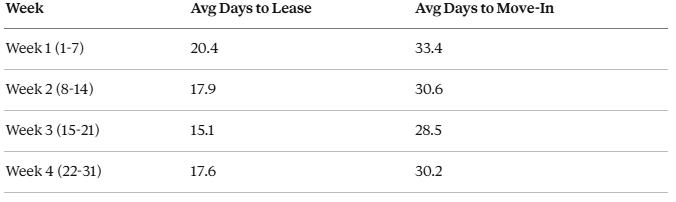

Breaking the data down by week of the month reveals a clear pattern:

Week 3, the 15th through 21st, delivers the fastest leasing times at 15.1 days on average. Week 1 is the slowest at 20.4 days. If you're structuring lease terms or negotiating move-in dates, aim for that third week sweet spot.

Often you can motivate approved applicants to start the lease 7-10 days sooner with the idea that they don't have to move everything in one day for the small price of just one weeks rent.

What You Can Do About It

Offer prorated move-ins aggressively. When a tenant wants a May 1st move-in but your unit is ready April 22nd, don't just accept the vacancy. Offer a prorated rent deal that gets them in sooner. Even a small discount on those 9 days is better than zero rent for 9 days.

Price the flexibility. If a tenant insists on holding a unit for a first-of-the-month start, consider whether your pricing reflects that accommodation. Some property managers charge a small lease initiation fee or require the holding period to be paid upfront, not as a penalty, but as recognition that the unit is being reserved.

Market to flexible tenants. Your listing language matters. Phrases like "available immediately" or "flexible move-in date" attract tenants who are ready to act. "Available June 1st" attracts tenants who will wait until June 1st, and expect you to wait with them.

Educate your leasing team. Make sure whoever is handling applications understands the cost of that 10-day hold. When a tenant asks for a first-of-the-month move-in, the leasing agent should be trained to counter with: "The unit is ready now, we can prorate rent and get you in this weekend. Would that work?"

Structure lease expirations strategically. If you're signing a new lease in April for a May 1st move-in, make it an 11-month lease that expires March 31st of the following year. That puts your next turnover in the spring leasing season rather than creating another May 1st cycle.

Or You Can Avoid Turnover

Landlords experience roughly 3 turnovers every 10 years based on the Chicago market average but for the last 3 years GC Realty & Development has had a lease renewal rate north of 80% which means instead of being better at solve the problem of faster move ins, which we do as well, we try to avoid the problem by providing service that gets current tenants to renew year over year.

Don’t Want To Go At This Alone?

We’ve shared a lot of information here on investing in real estate locally in Chicagoland. If you live outside the area, it may seem overwhelming for those wanting to invest in the Chicago market. But we really just look at it as a team sport.

Who’s on your investing team? Do you even have a team? GC Realty & Development, LLC has a dedicated team of professionals willing to share decades of experience in all facets of real estate investment. We handle everything from brokerage, leasing, and property management. Whether you hire us or not, we’re happy to provide our resources and expertise.

What gets me up in the morning and keeps me going 12 hours a day is the ability to add value to local area investors in Chicago and beyond! Those who connect with me often hear me say that our goal is to bring value to everyone we come in contact with.

We hope that in return, they will one day hire us for our tenant placement or property management services, refer us to someone they know, or leave a review about our services. We would clearly love all three; however, we’re happy whenever we get the opportunity to help!

Reach out today!

Partner / Co-Host of Straight Up Chicago Investor Podcast

Vendor Portal

Vendor Portal