Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

Recently we published several articles breaking down GC Realty & Development's 2025 lease renewal performance, looking at retention rates, rent increases, and the city versus suburb dynamics. Those pieces generated solid feedback from Chicago investors and got me thinking how did these numbers compare to 2024 and are there any trends we can spot.

So I went back into our 2024 data. That gives us eight full quarters to analyze, covering 1,761 residential lease expirations across our portfolio. Between 2024 and 2025, GC Realty & Development managed roughly 1,200 to 1,400 residential units at any given point, with properties scattered fairly evenly throughout Chicago and the suburbs. The portfolio spans A, B, C, and D class properties, though D class represents the smallest slice but just enough to represent properly but not small enough to count it out. This mix gives us a representative sample of what's happening across the broader Chicago rental market.

What jumped out as I looked toward 2026?

The Big Picture: Higher Rents, More Turnover

Let's start with the headline numbers across the full 24 months:

Metric | 2024 | 2025 | Change |

Total Expirations | 870 | 891 | +21 |

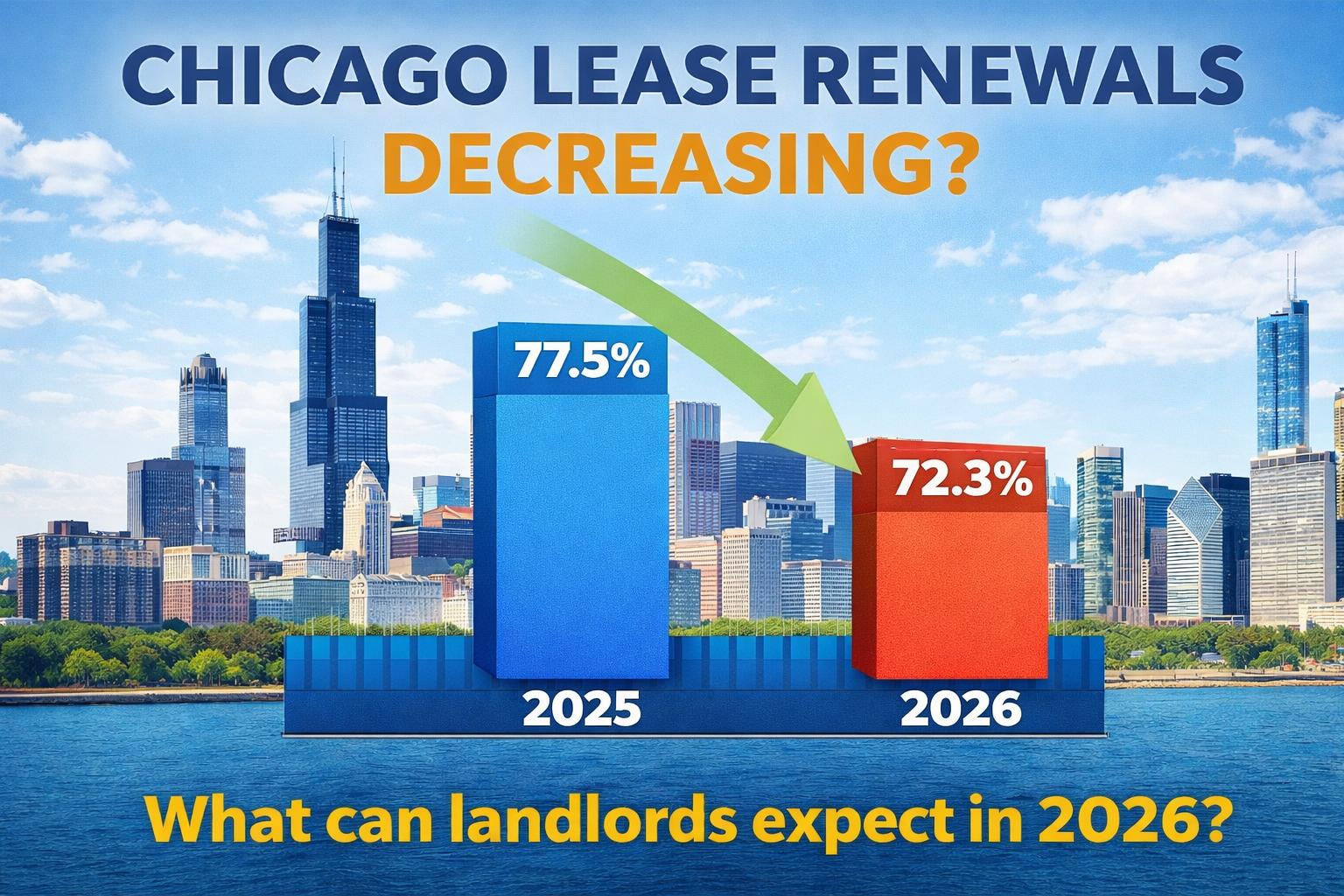

Renewal Rate | 77.5% | 72.3% | -5.2 pts |

Average Increase | 4.4% | 6.7% | +2.3 pts |

Median Increase | 4% | 6% | +2 pts |

What really surprised me looking back at 2024 was how strong our renewal rates actually were. The Chicago city average renewal rate in 2024 was just 58.1%. Suburban Chicago came in at 68.2%. Our portfolio hit 77.5%, nearly 20 percentage points above the city average and almost 10 points above the suburbs. At the time, we thought we were just running good operations. Looking at the data now, we were significantly outperforming the market. That context makes the 2025 drop to 72.3% look different. Yes, we lost about 5 points year over year, but we're still outperforming the broader market. The 2024 numbers were exceptional, maybe even unsustainable.

Looking back at our internal notes from the end of 2024, we actually flagged this at the time. We saw the crazy high renewal rates and had a clear takeaway: we were probably leaving money on the table and should be pushing harder on rent increases. The data was telling us our pricing was too conservative.

So in 2025, we did exactly that. As the property manager, we worked with our landlords to push harder on renewals, and yes, we paid for it in turnover. But here's the thing: that's not always a bad thing. Higher turnover with stronger rent bumps can absolutely make sense depending on your market and your costs. The real question is whether the increased rent on renewals plus the bump you get when re-leasing to new tenants outweighs the vacancy loss and turnover costs. I'll have to break down the rent difference between tenants who didn't renew and what those same units re-leased at in a future article. That's where the real math lives.

A 2.3 percentage point increase in rent bumps cost about 5 points in retention. That's the trade-off playing out across the Chicago market. Whether that math works depends entirely on your turnover costs and time to re-lease in your specific submarket.

The Quarter-by-Quarter View

Here's where the data gets interesting. Looking at all eight quarters reveals patterns that annual averages obscure:

Quarter | Expirations | Renewed | Rate | Avg Increase |

Q1 2024 | 274 | 205 | 74.8% | 5.0% |

Q2 2024 | 310 | 237 | 76.5% | 4.7% |

Q3 2024 | 256 | 208 | 81.2% | 3.4% |

Q4 2024 | 30 | 24 | 80.0% | 4.2% |

Q1 2025 | 267 | 184 |

Q3 2024 stands out as the highest renewal rate over the 2 years look back. We averaged just 3.4% increases and achieved 81.2% retention. That's the highest retention rate across all eight quarters. Then came Q1 2025, and everything shifted. Average increases nearly doubled to 8.0%, and retention dropped almost 12 points from the prior quarter.

Was it based on time of year, the push on rental rates, or just coincidence? Looking at eight quarters of data, it's probably some combination of all three. But the consistency of the patterns tells me this isn't random.

One thing worth noting about our process at GC Realty & Development. Before we go to any tenant with an increase that risks them moving out, we have individual conversations with that property owner to weigh the risk versus reward. Every property is different. Every owner has different cash flow needs, different tolerance for vacancy, and different long-term goals. Some owners want to maximize rent even if it means turnover. Others prioritize stability and are happy leaving a little on the table to keep a good tenant in place. That owner-by-owner approach is baked into these numbers, which means the aggregate data reflects hundreds of individual decisions, not a blanket pricing strategy.

The 2024 Highs Were Unsustainable

Looking back, 2024's retention numbers were exceptional, maybe even anomalous. Hitting 81.2% renewal rates in Q3 while still pushing some rent increases reflects a market where tenants had limited options or strong incentives to stay put. By 2025, that dynamic shifted. Tenants became more willing to move, and landlords who priced aggressively felt the consequences.

The year-over-year comparison by quarter tells the story clearly:

Quarter | 2024 Rate | 2025 Rate | Change |

Q1 | 74.8% | 68.9% | -5.9 pts |

Q2 | 76.5% | 69.5% | -7.0 pts |

Q3 | 81.2% | 73.6% | -7.6 pts |

Q4 | 80.0% | 67.6% | -12.4 pts |

Every single quarter saw retention decline year over year. Q4 took the biggest hit at 12.4 points, though the smaller sample sizes in Q4 (30 and 34 expirations respectively) mean we should take that with a grain of salt. The consistent pattern across Q1 through Q3, where sample sizes are robust, confirms the trend is real.

Understanding Chicago and Cook County Lease Renewal Time Frames

Before we go any further, it's worth understanding the regulatory framework we're operating under. Chicago and Cook County have some of the strictest lease renewal notice requirements in the country, and they directly impact how we manage the renewal process.

Under the Chicago Fair Notice Ordinance, landlords must provide written notice before raising rent or non-renewing a lease. If a tenant has lived in the unit for more than six months but less than three years, you're required to give 60 days notice. But here's where it becomes a pain to Landlords and their process. If that tenant has been in place for more than three years, the notice requirement jumps to 120 days. That's four months of lead time before you can implement a rent increase or let them know you're not renewing.

For property managers, this creates a real operational challenge. You can't wait until 60 days out to start the conversation with a long-term tenant and then scramble if they decide to leave. By the time you know their decision, you've already blown past the window to properly market the unit for peak leasing season.

That's why we start the lease renewal process 150 days before expiration and begin conversations with tenants around 130 days out. This gives us a comfortable cushion above the 120-day requirement for our longest-tenured residents, and it gives both the owner and the tenant time to make informed decisions without anyone feeling rushed. It also means we're having renewal conversations in a completely different season than when the lease actually expires, which factors into how we think about pricing and market conditions.

Chicago Vs Suburbs Renewals

One of the more striking findings was Chicago landlords completely flipped their approach between 2024 and 2025. In 2024, city landlords were the conservative ones, averaging just 3.3% increases compared to 5.0% in the suburbs. By 2025, city landlords became the aggressors, pushing 6.9% average increases versus 6.5% in the suburbs.

The quarterly city data shows the transformation. In Q3 2024, Chicago landlords averaged just 1.3% increases and achieved an incredible 86.1% retention. In Q3 2025, they pushed 8.1% increases and retention fell to 70.5%. That's a complete strategic reversal within 12 months.

Going into 2025, something shifted in the conversations we were having with Chicago landlords. The tone changed. Owners who had been conservative on rent increases for years started pushing back, asking why we weren't going higher. The driver was 100% around their costs continuing to go up. Property taxes continued their relentless climb, but insurance became the topic nobody could stop talking about. Premiums jumped 20%, 30%, sometimes more, and landlords who had been absorbing increases for years hit a breaking point. The math stopped working at 3% rent bumps when insurance alone was eating up twice that. This wasn't Chicago landlords getting greedy; it was landlords trying to keep their properties cash-flow positive.

Meanwhile, suburban landlords showed more consistency. They maintained the same seasonal pattern both years: stronger pricing in Q1 and Q2, then pulling back in Q3 and Q4. In Q3 2025, suburban landlords moderated to 4.7% average increases (close to their 2024 levels) and recovered retention to 75.1%, the best quarter of the year.

What This Means for 2026

Stay conservative on increases and you improve your chances of renewal. Push harder and you're playing a game of risk versus reward.

That's not a criticism of either approach. Some owners need cash flow stability and will happily leave a few dollars on the table to keep a good tenant in place. Others are willing to absorb a month or two of vacancy to reset rents to market. Both strategies can work. The key is being intentional about which game you're playing.

What the eight quarters of data make clear is that you can't have it both ways. The landlords who pushed 8% increases and expected 80% retention learned that lesson in 2025. The math doesn't work like that.

Going into 2026, know your numbers. Understand your turnover costs. Have honest conversations with your property manager about what you're optimizing for. And remember that every lease renewal is its own negotiation with its own set of variables. The trends in this article give you a framework, but the decision on each property still comes down to the specific owner, the specific tenant, and the specific market conditions at that moment.

1,761 lease expirations across eight quarters gave us a clear picture of where the Chicago rental market has been. Use it to make smarter decisions about where you're headed.

Don’t Go At This Alone

This is a lot of information you need to know if you plan to invest here in the Chicago market and it may seem overwhelming but real estate investing in Chicago is a team sport. Who is on your real estate investing team? Do you have a team? GC Realty & Development has a team of resources and we are willing to share all of our 20+ years of experience in both real estate investing and Property Management in the Chicago market. We will do this whether you hire us or not.

What gets me up in the morning and keeps me going 12+ hours a day of work is the ability to add value to Chicago real estate investors. If we connect you will here my say our goal of our company is to have value to have everyone we come in contact with and in return we hope one day you will hire us for our Tenant Placement or Property Management Services You can also refer us to someone you know that needs Tenant Placement or Property Management Services, or I will take a simple 5 Star Google review. We love the opportunity when we get all three from current and aspiring investors we get to help!

Reach out today!

Partner / Co-Host of Straight Up Chicago Investor Podcast

Vendor Portal

Vendor Portal