Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

As a Chicago landlord, measuring the performance of your rental portfolio is essential to long-term success. Without a structured system for monitoring results, it becomes difficult to identify issues early, make informed financial decisions, or maximize your returns. Tracking the right key performance indicators helps property owners stay competitive in a fast-moving rental market while ensuring that every property continues to meet their strategic objectives.

Key performance indicators allow you to see what’s working, what needs improvement, and how well your real estate investments are performing over time. In this blog, we will outline the right KPIs to track for your Chicago rental property and explain how these metrics support better decision-making and portfolio growth.

Key Takeaways

Key performance indicators reveal financial and operational insights that help you monitor progress effectively.

Property management KPIs allow you to evaluate tenant satisfaction, revenue performance, and operational efficiency.

Leading indicators highlight potential issues early while lagging indicators confirm long-term outcomes.

Tracking leading KPIs consistently allows property managers and owners to make data-informed improvements that protect long-term profitability.

Why KPIs Matter for Chicago Rental Property Performance

Chicago’s rental market is diverse, competitive, and highly influenced by neighborhood trends. If you manage a single unit or an expanding portfolio, the right key performance indicators give you the clarity needed to measure progress and support your strategic focus.

Many landlords use property management software to automate KPI reports and reduce manual data entry. Tools like these allow you to track progress without spending hours analyzing spreadsheets. More importantly, they help property managers evaluate patterns that relate to resident behavior, maintenance performance, and financial outcomes.

One of the best starting points is monitoring essential financial KPIs. Metrics such as net operating income, cash flow, revenue growth, and net profit margin allow you to understand whether your rental property is generating strong returns. Linking certain costs to your financial KPIs also helps you identify areas where performance improvement may be needed. If expenses begin trending upward, detailed maintenance reporting from a reliable maintenance service can help you pinpoint and reduce inefficiencies.

The Most Important Financial KPIs for Chicago Landlords

Financial KPIs serve as the foundation for evaluating the performance of your rental property. These metrics show how well your investment is generating income after accounting for expenses and vacancy fluctuations.

Net Operating Income

Net operating income is one of the most important key performance indicators for real estate investors. It measures your total income after subtracting operating expenses like repairs, utilities, and property taxes. Consistently rising net operating income indicates healthy financial performance.

Cash Flow

Cash flow determines the amount of income left after paying all expenses and debt obligations. A positive cash flow ensures your rental business can support ongoing costs while providing profit each month.

Net Profit Margin

Net profit margin is one of the financial KPIs that analysts use to determine overall profitability. This metric helps property owners evaluate the percentage of income that becomes profit after all expenses are paid. Access to optimized accounting tools that streamline reporting can help you easily review these figures using your accounting record.

Operational KPIs That Support Stable Rental Performance

While financial KPIs show how well your portfolio is performing overall, operational property management KPIs help you understand your day-to-day performance. These indicators measure productivity, tenant satisfaction, and the effectiveness of your processes.

Customer Satisfaction

Customer satisfaction metrics help landlords measure the quality of service provided to residents. High customer satisfaction often leads to better customer retention, longer lease terms, and fewer vacancies.

Customer Retention

Satisfied residents tend to stay longer. Tracking customer retention gives you insight into how well your property manager supports tenant needs and how your service quality impacts resident stability.

Performance Improvement Trends

These metrics reveal whether your operations are becoming more efficient over time. For example, analyzing maintenance response times or tenant onboarding efficiency can show whether you are making strides in performance improvement.

Leading and Lagging Indicators Every Chicago Landlord Should Track

Understanding both leading indicators and lagging indicators is essential for long-term success. Together, they create a full picture of how well your rental property is performing in the present while predicting future outcomes.

Leading Indicators

Leading indicators predict future performance. These include tenant satisfaction scores, average maintenance response times, and leasing inquiry volume. When leading indicators trend downward, it serves as an early warning sign.

Lagging Indicators

Lagging indicators reflect past performance. These include revenue growth, vacancy rates, and net profit margin. They confirm how effective your strategies were after a period of time.

Using both leading and lagging KPIs provides a balanced perspective on your rental property’s current health and future potential.

How KPI Dashboards Help Property Owners Stay Organized

KPI dashboards organize all your key performance indicators into one centralized system. Many property managers use dashboards to help property owners monitor progress and review their leading and lagging KPIs in real time.

Dashboards also reduce manual data entry, making it easier to track progress without wasting time. With smart tools and automated reporting, landlords can stay on top of financial performance, maintenance efficiency, and tenant satisfaction all at once.

Strategic KPIs are essential in this process. They help align your decisions with your long-term goals while supporting your strategic focus. Whether your priority is customer lifetime value, performance improvement, or revenue growth, dashboards offer the visibility needed to measure progress accurately.

FAQs

What are key performance indicators and why are they important for landlords?

Key performance indicators are measurable metrics that show how well your rental property is performing. They help property owners track progress, make data-driven decisions, and identify opportunities for improvement.

What is the difference between leading indicators and lagging indicators?

Leading indicators predict future performance while lagging indicators measure past outcomes. Landlords need both to evaluate stability, anticipate issues, and confirm results.

How can KPI dashboards support multi-property management?

KPI dashboards consolidate financial and operational data into a single platform. This allows landlords to view trends, analyze performance, and take action without relying heavily on manual data entry.

Why is customer satisfaction an essential KPI for Chicago rentals?

Customer satisfaction is tied to customer retention. Happier residents renew leases more often, reducing turnover costs and supporting long-term profitability.

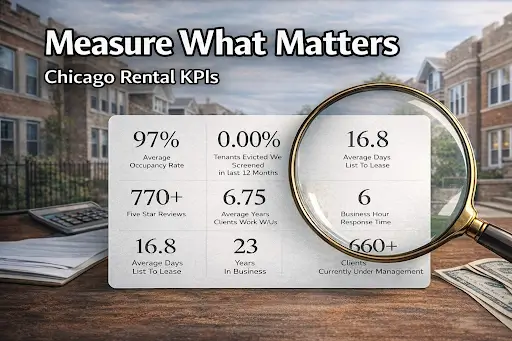

Partner with GC Realty to Maximize Your Chicago Real Estate Returns

We’ve shared a lot of information here on investing in real estate locally in Chicagoland. If you live outside the area, it may seem overwhelming for those wanting to invest in the Chicago market. But we really just look at it as a team sport.

Who’s on your investing team? Do you even have a team? GC Realty & Development, LLC has a dedicated team of professionals willing to share decades of experience in all facets of real estate investment. We handle everything from brokerage, leasing, and property management. Whether you hire us or not, we’re happy to provide our resources and expertise.

What gets me up in the morning and keeps me going 12 hours a day is the ability to add value to local area investors in Chicago and beyond! Those who connect with me often hear me say that our goal is to bring value to everyone we come in contact with.

We hope that in return, they will one day hire us for our tenant placement or property management services, refer us to someone they know, or leave a review about our services. We would clearly love all three; however, we’re happy whenever we get the opportunity to help!

Reach out today!

Partner / Co-Host of Straight Up Chicago Investor Podcast

Vendor Portal

Vendor Portal