Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

Most Chicago landlords have no idea what the Chicago Housing Authority (CHA), more commonly known as Section 8, will actually pay them until it's too late. They accept an application, wait 30 days, go through inspection, then find out the numbers don't work. Having placed over 400 Section 8 tenants in properties we developed, plus what we see managing 1,400+ units at GC Realty & Development, I've learned exactly what you have to ask upfront during the application process and what to watch out for that can bite you in the rear.

Let me walk you through exactly what you need to know to accurately predict your rent determination, and help you avoid the costly mistakes I see investors make.

Chicago vs. Suburbs: Two Different Systems

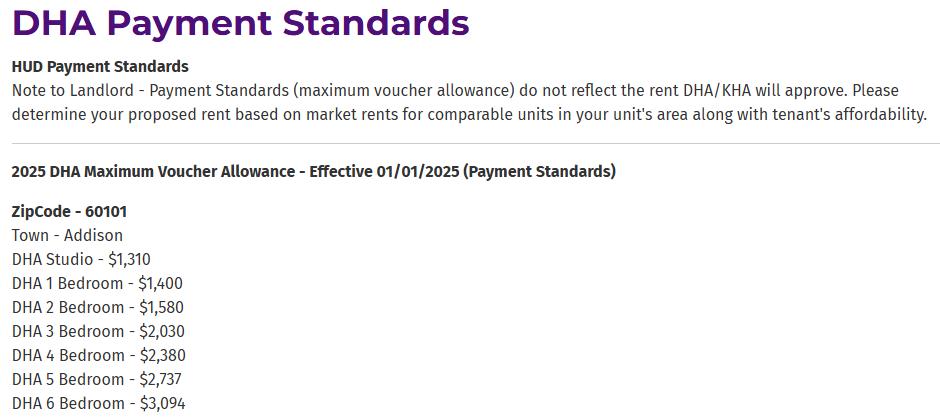

Before we dive into the details, understand that this conversation breaks into two completely different approaches depending on your property location. If you're out in the collar counties, Will County, Cook County suburbs, DuPage, you can simply Google the payment standards. Search "Will County payment standards" or "Cook County payment standards," and you'll find the maximum amount the housing authority will pay based on zip code and bedroom count.

But here's what catches people: that maximum you see on a chart assumes you as the landlord are paying all utilities. If you're renting out your single-family home in Bolingbrook and Will County shows $3,300 for a three-bedroom, that's with you covering gas, electric, water, everything. Every utility you put back onto the tenant, which is typical, reduces that number. Subtract roughly $100 for each utility. So if the tenant pays gas, electric, and water, your realistic max drops to around $3,000.

Picture Above: Example of Dupage County website showing breakdown by zipcode for the max they will pay you as the Landlord assuming you pay all utility bills.

Chicago operates completely differently, which brings us to the most important document you need to understand.

The Rent Burden Sheet: Your Most Critical Document

In Chicago, when someone applies for your property, one of our requirements at GC Realty during the application process is requesting a copy of the rent burden sheet. This document is between CHA and the tenant, and it tells you everything you need to know about what that specific applicant can actually afford.

Now, some tenants get fussy about this. They'll say they can't give it to you or claim someone told them not to share it. That's complete nonsense. My response is simple: that's fine, but I won't be able to approve you if I can't verify what you can afford. They have that rent burden sheet, and you need to see it.

On that sheet, you'll find the maximum amount they qualify for. But remember, you still need to back out utilities just like the suburbs. Electric, gas, water: subtract about $100 for each one from that top-line number. This calculation on the front end prevents the frustration I see constantly where investors go through the entire process only to discover the numbers never worked from the start.

Voucher Sizes: The Mismatch That Kills Deals

This happens more times than not. A lot of tenants apply for your three-bedroom property, but they're only carrying a two-bedroom voucher. This is incredibly common, two-bedroom vouchers looking at three-bedrooms, three-bedroom vouchers looking at fours, four-bedrooms looking at fives.

Here's the critical understanding: that tenant can rent your larger unit, but you'll hit a ceiling on payment based on their voucher size, not your bedroom count. If someone has a two-bedroom voucher and they're looking at your three-bedroom property, you won't get approved for three-bedroom payment standards just because you physically have three bedrooms. You'll only receive the two-bedroom maximum.

This matters enormously for your investment analysis. You might list a property expecting three-bedroom Section 8 income, but if your applicant pool consists mainly of two-bedroom voucher holders, your actual rental income will be significantly lower than projected.

And here's another reality check: five and six-bedroom vouchers are incredibly rare. This changed back in 2012 when they adjusted household composition requirements. It used to be two kids per bedroom if they were the same sex. Now the rules have tightened. You could have eight kids and a parent and only qualify for a five-bedroom voucher. So if you're buying that large single-family thinking you'll capture premium Section 8 income, understand your tenant pool is extremely limited.

Bedroom Qualification Standards: Where Deals Actually Die

This section will save some of you serious money and headaches. What qualifies as a bedroom in Chicago for Section 8 purposes has specific technical requirements, and this is where I see investors make critical errors constantly.

The minimum is 70 square feet. Not 69 and a half, 70 square feet, very clearly. One thing people don't realize: you don't actually need a closet. A room without a closet can still qualify as a bedroom. But I always tell investors to think about what's right for the tenant. People still want closets.

Now, 70 square feet is tiny. But here's where investors really run into problems: attic bedrooms and basements.

The Ceiling Height Trap

For any bedroom, the only floor space that counts toward your 70 square feet is area where the ceiling is seven feet or higher. Think about what this means for an attic bedroom with a sloped or vaulted ceiling. When you get to those corners where the roof angles down, none of that space counts. Some attic bedrooms, once you measure properly, only have usable space running down the middle of the room. What looked like a generous bedroom might actually measure only 60 qualifying square feet, and suddenly it doesn't count as a bedroom at all.

Basements create the same problem, often worse. Picture a room that's 10 by 7 feet, that's 70 square feet exactly. But if you have a soffit running through that room bringing the ceiling down to 6 feet or 6'2" in that section, that entire soffit area doesn't count toward bedroom size. Your 70-square-foot room just became a 50-square-foot room, and it no longer qualifies.

I've seen investors purchase properties advertised as four or five bedrooms, only to have CHA classify them as three-bedrooms after inspection. Their entire investment analysis was built on income that was never actually achievable.

Ventilation Requirements

There's a common misconception about windows. You don't need a window that opens, you just need something that ventilates. I've had buildings where basement bedrooms have glass block windows with just a small cutout in the middle that opens with a screen. That counts for Section 8. But if you have solid glass block with no ventilation option, that room won't qualify.

What You Cannot Do: Side Payments

I'm going to say this clearly because I see it happen all the time. Investors tell me they have a tenant paying $2,000 from CHA plus $400 on the side. Do not do this.

You cannot accept anything above your HAP contract amount. The Housing Assistance Payment Contract, also known as HAP, is the agreement between you and the housing authority. In this case Chicago Housing Authority(CHA). The penalties are severe, you get banned from the program, and there are other HUD housing consequences. Plus, it's not even enforceable. Who are you going to tell when they stop paying? You can't report to CHA. You can't file for eviction on that amount. You simply cannot chase it.

What you can do legitimately: charge separately for parking or storage at actual market rates. But be realistic, nobody's renting parking spots in Humboldt Park for $900 a month.

Let's Talk About Your Section 8 Strategy

Whether you're exploring your first Section 8 rental or you're an experienced landlord looking to tighten up your process, my team at GC Realty and Development handles this daily across our portfolio. If you have questions about rent burden sheets, voucher qualifications, or bedroom standards, schedule a call with us. We'll help you predict your rent determination accurately, before you learn expensive lessons the hard way.

If you'd rather skip the headaches entirely, learn more about our tenant placement or property management services for most anywhere around Chicagoland.

Vendor Portal

Vendor Portal