Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

Here's something you almost never see in Chicago real estate: raw, transparent leasing data from an actual property management company. Most managers or investment groups guard this information like a trade secret or something more risque than just numbers. Some may have mispriced a few properties and are ashamed that those errors “messed up” their stats. But having this data can fundamentally change how you plan your investment strategy.

On the Straight Up Chicago Investor podcast, we talk constantly about making data-driven decisions. But most investors fly blind when it comes to realistic vacancy expectations. GC Realty & Development, LLC has 23 years of experience managing over 1,400 units across the Chicago metro area. But we know you’re only as good as your last year. That’s why I want to walk you through exactly what we saw across 391 leased properties in Chicago in 2025.

Fast Facts Numbers

GC Realty & Development, LLC 2025 By The Numbers | |

22 Mean Days on Market | 16 Median Days on Market |

391 Properties Leased | 6 Mean-Median Gap Days |

Why You Need Both Mean and Median

The mean (22 days) accounts for every property, including outliers that sat for 60, 80, or even 117 days. These difficult properties boost the average (but we’re not ashamed, we’re sharing). The median (16 days) tells you half of the properties leased faster than 16 days, your "typical" experience when pricing correctly.

Why do you need both numbers? Because the analysis helps investors make real-world plans. For example, use the median (16 days) for cash flow projections on well-maintained properties. You can also use the mean (22 days) when budgeting reserves for challenging properties, pet restrictions, third-floor walk-ups, or less desirable locations.

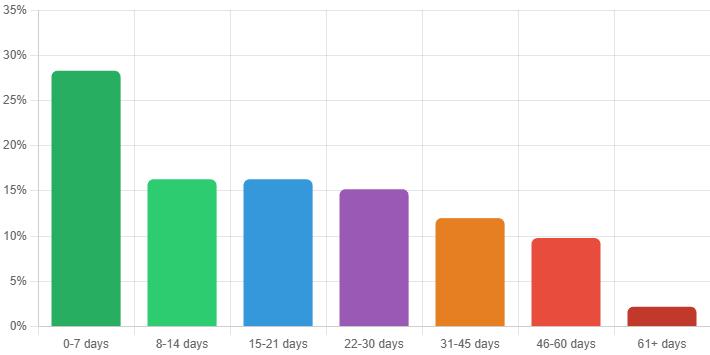

Days on Market Distribution - 2025 Leasing Data

Looking back at 2025 data, over 44% of properties under our management are leased within two weeks. That's what happens with proper pricing and responsive showings. About 12% took more than 45 days. These outliers all had controllable factors when we looked back. The main culprit: pricing.

And then came the curve wreckers: we had one client in 2025 who needed a specific number for refinance ratios. But that client wouldn't offer the free rent incentives until after Day 60 on the market. We also had a couple of unique properties that were hard to compare to anything else. It took some time to land on the right price point to secure a signed lease agreement.

[Get a free rental analysis today in less than 1 minute.]

The Difference a Month Makes

Sometimes it can be hard to believe that one month can make a difference in how quickly tenants sign for a vacant rental property.

The Two Fastest Months: February and March

February and March mark the start of "moving season" in Chicago. Renters start searching 30-60 days before their desired move-in dates. Tax refunds arrive. The weather improves. The combination creates urgency and a larger pool of renters.

The Slowest Month: January

January posted our slowest numbers in 2025, 25 days mean, 21 median. That's roughly 50% longer than our fastest months. The holiday season creates a pause in the rental market. Units hitting the market mid-December often sit through the holidays with minimal showings. People are too busy to think about adding moving into the holiday mix.

Strategic Implication: Structure leases to expire late February through mid-March. This positions you to list during peak demand and minimizes vacancy exposure.

The Two Fastest Months: March and February

What This Means for You, Chicago Investors

Access to this much data only benefits you if you know what to do with it! Based on our numbers, we’ve offered a few suggestions to help Chicagoland investors get the most out of their investments.

Cash Flow Planning

Budget roughly three weeks of vacancy between tenants. For annual projections, that's roughly a 5-6% vacancy factor on renewals. Yes, the goal is zero vacancy for most Chicago investors, especially on the North and Northwest side, but plan for three weeks. Anything better is cash direct to the bottom line.

Renovation Timing

Plan to complete unit renovations by mid-February to hit peak season with a fresh unit. Finishing in November means listing during the slowest period.

Pricing Strategy

Properties leasing within a week were priced at or below market. Properties sitting for 45+ days often start overpriced. In slower months, we recommend you price aggressively from Day One. Looking back at the few properties that sat longer, it was 100% a pricing issue where we were unable to get our clients on the same page as us. This especially hurt our clients going into the post-Labor Day market, where you have to chase the market down if you don't adjust quickly enough.

[Download free eBook: What They Don’t Tell You About Real Estate Investment]

Don’t Want To Go At This Alone?

We’ve shared a lot of information here on investing in real estate locally in Chicagoland. If you live outside the area, those wanting to invest in the Chicago market could get overwhelmed. But at GC Realty & Development, LLC, we really see property management as a team sport.

Who’s on your investing team? Do you even have a team? GC Realty & Development, LLC has a dedicated team of professionals with decades of experience across all facets of real estate investment. We handle everything from brokerage to leasing and property management. Whether you hire us or not, we’re happy to provide our resources and expertise.

What gets me up in the morning and keeps me going 12 hours a day is the ability to add value to investors in Chicago and beyond! Those who connect with me often hear me say that our goal is to bring value to everyone we come in contact with.

We hope that, in return, they will one day hire us for our tenant placement or property management services, refer us to someone they know, or leave a review about our services. We'd love all three; however, we’re happy whenever we get the opportunity to help!

Reach out today!

Partner / Co-Host of Straight Up Chicago Investor Podcast

Vendor Portal

Vendor Portal